Game Strategy Guide

As we embark on this journey through the game, it's important to understand that Level 1 is designed with a unique approach compared to the subsequent levels. So there are basically 2 types of levels:

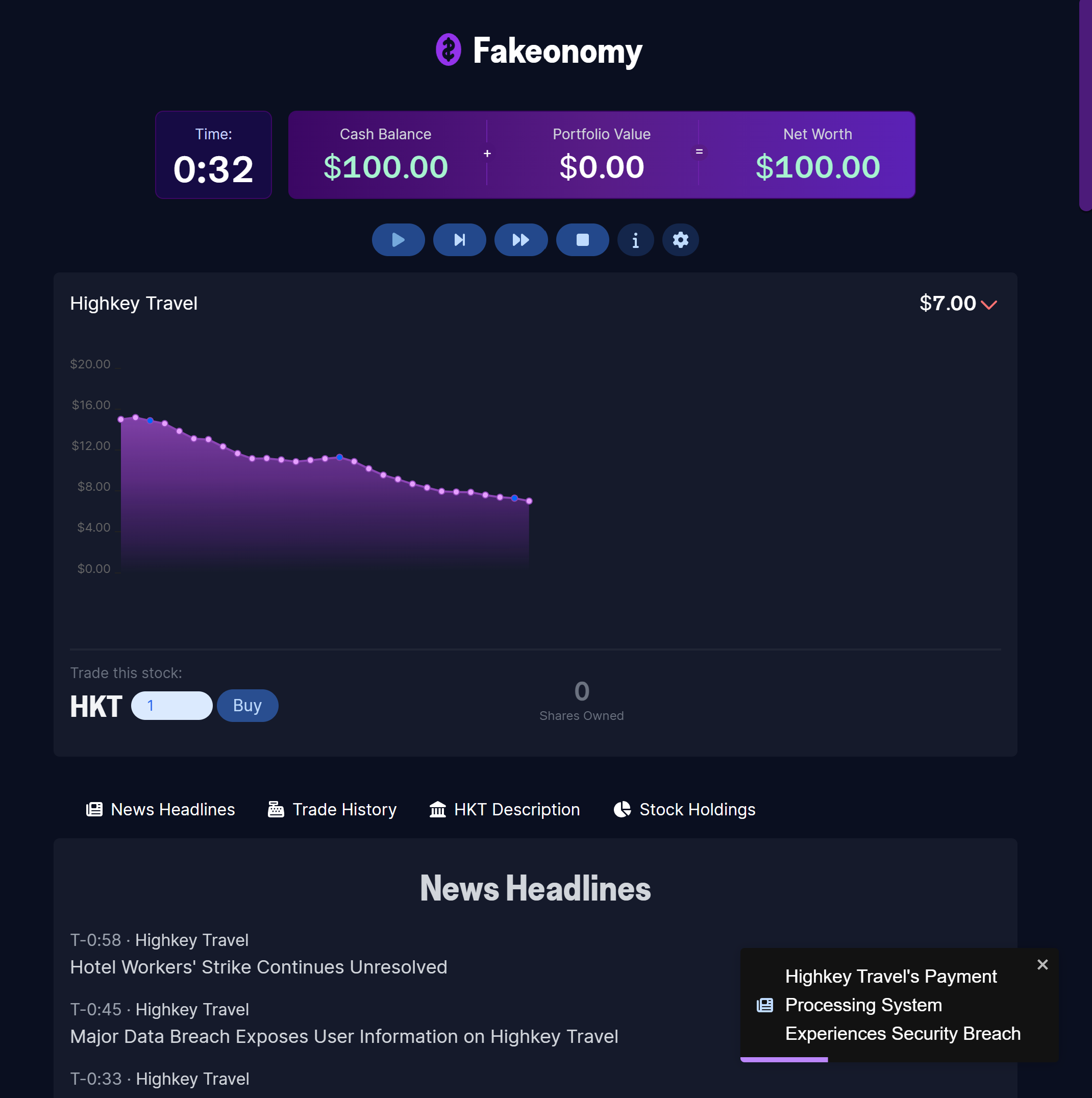

Level 1: The Power of Prediction

The first level is all about observation and prediction. Keep a close eye on the news events unfolding around you. These events can have a significant impact on the game's dynamics. Your task is to anticipate these effects and adjust your strategy accordingly. Successful prediction and adaptation are the keys to conquering this level.

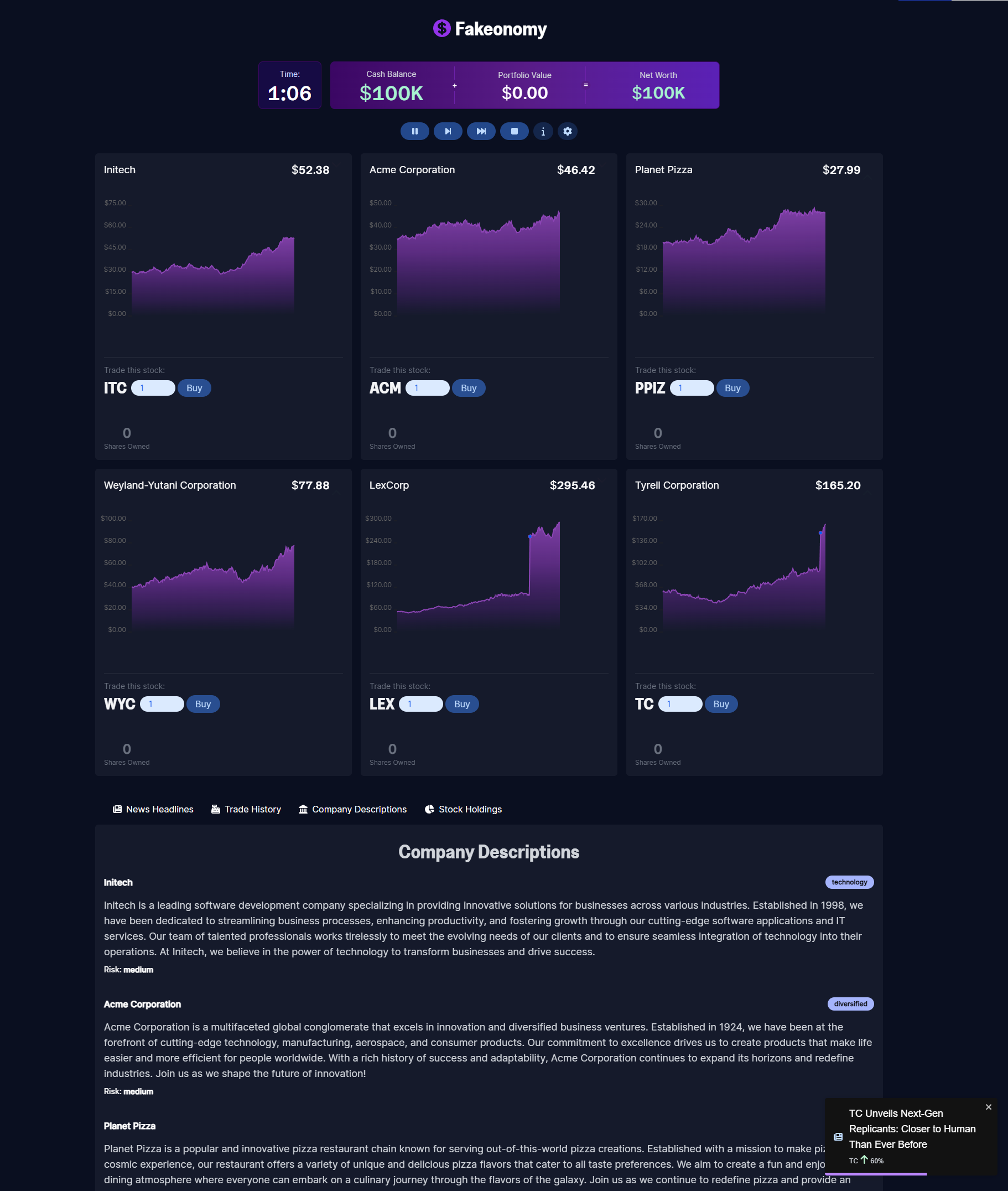

Level 2-6: Understanding Risk and Recognizing Trends

Level 1: The Power of Prediction

As you progress to levels 2 through 6, the game becomes more complex and challenging. Here, you need to monitor the risk levels associated with different companies. Remember, each company is unique. Some may be more volatile, while others may consistently perform well. Certain companies might be highly sensitive to news events, swinging wildly based on the latest headlines. Playing multiple times will help you understand these trends better. Over time, you'll start to notice patterns and be able to predict which companies are likely to thrive and which are prone to volatility. Use this knowledge to your advantage, adjusting your strategy to maximize gains and minimize losses. Remember, understanding and adapting to the game's ever-changing landscape is the key to success. So, keep playing, keep learning, and most importantly, get that money!

Mastering Trading Strategy

Trading in the stock market requires a keen understanding of both technical analysis and fundamental factors influencing stock prices. Whether you're a novice investor or an experienced trader, mastering these strategies can significantly enhance your success in the market.

Technical Analysis: Riding the Waves

Technical analysis involves analyzing historical price and volume data to identify patterns and trends in stock prices. By studying charts and indicators, traders can make informed decisions about when to buy or sell a particular stock.

One common strategy is trend following, where traders capitalize on upward or downward trends in stock prices. For example, if a stock's price is consistently rising, traders may opt to buy and hold the stock until the trend reverses.

Another popular approach is momentum trading, which involves buying stocks that are gaining momentum in the market. Traders look for stocks with strong price movements and high trading volumes, hoping to ride the momentum for short-term profits.

Fundamental Analysis: Digging Deeper

Fundamental analysis focuses on evaluating a company's financial health and growth prospects to determine its intrinsic value. Traders assess factors such as earnings reports, revenue growth, and industry trends to gauge the stock's future performance.

When analyzing news events, traders pay close attention to market sentiment and investor reactions. Positive news, such as earnings beats or new product launches, can drive stock prices higher, while negative news, such as regulatory concerns or economic downturns, may lead to price declines.

Successful traders combine technical and fundamental analysis to develop a comprehensive trading strategy. By staying informed about market trends, monitoring stock price movements, and reacting swiftly to news events, traders can navigate the complexities of the stock market with confidence and agility.